Jharkhand High Court

Delay Of 17 Months In Filing Appeal Not Condonable U/S 107 Of CGST Act: Jharkhand High Court Dismisses Plea Challenging Cancellation Of Registration

The Jharkhand High Court has held that an appeal filed beyond the statutory period of limitation, as prescribed under Section 107 of the Central Goods and Services Tax Act, 2017, is not maintainable and the delay cannot be condoned beyond the limits expressly stated in the statute. The Division Bench comprising Chief Justice M. S. Ramachandra Rao and Justice Deepak Roshan held, “Even otherwise, since specific period has been enshrined in the statute itself, the same cannot be condoned. Thus, we...

Withholding Tax Refunds Without Justification Violates Section 55 Of JVAT Act: Jharkhand High Court

The Jharkhand High Court has held that withholding tax refunds beyond the statutorily prescribed period without adequate justification, violates Section 55 of the Jharkhand Value Added Tax Act, 2005, and deprives the taxpayer of rightful dues. The Court ruled that the refund must carry interest from the date the excess demand was determined, and non-allocation of funds by the State cannot override this obligation.In the words of the Division Bench comprising the Chief Justice MS Ramachadran Rao...

Pendency Of Proceedings Before Competent Authority Under Jharkhand Apartment Ownership Act Will Not Affect Application U/S 11 Of A&C Act: Jharkhand HC

The Jharkhand High Court Bench of Chief Justice M.S. Ramachandra Rao has observed that 'competent authority' within the meaning of Section 3(l) of the Jharkhand Apartment (Flat) Owners Act, 2011 is an executive authority and not a quasi-judicial or judicial authority. Accordingly, pendency of some proceedings under the said Act would not preclude the court from appointing an arbitrator if there is a valid arbitration clause between the parties. Facts The Applicant and the deceased ...

Jharkhand High Court Orders ₹1.23 Crore GST Refund To Tata Steel Over ITC On Compensation Cess

The Jharkhand High Court has ordered Rs. 1,23,22,617/- GST refund to Tata Steel, whose largest steel plant is situated in State's Jamshedpur city.The amount represented Input Tax Credit (ITC) on Compensation Cess paid by the company under Section 8(2) of the Goods and Service Tax (Compensation to States) Act, 2017 for purchasing its key raw material- Coal.Finding that the refund was denied by the State on 'extraneous grounds', the division bench of Chief Justice MS Ramachandra Rao and Justice...

Jharkhand HC Directs Tax Authorities To Follow Due Procedure While Passing Orders; Imposes Costs For Passing Order Violating Natural Justice

The Jharkhand High Court directed the state tax authorities to follow due procedure while passing adjudication orders. The Division Bench of Chief Justice Ramachandra Rao and Justice Deepak Roshan stated that “despite directions issued by the Court, it appears that State Tax authorities are continuing to conduct adjudication proceedings in utter disregard to the mandatory provisions of the Act and in violation of the principles of natural justice.” In this case, a show cause notice...

Department Retaining Balance Amount After Tax Demand Is Reduced Violates Article 14 & Article 265 Of Constitution: Jharkhand High Court

The Jharkhand High Court stated that retaining balance amount by department after the tax demand is reduced is violative of Article 14 & Article 265 of the constitution. The Division Bench of Chief Justice M.S. Ramachandra Rao and Justice Deepak Roshan observed that the department cannot retain the amounts deposited by the assessee pursuant to condition imposed by the appellate authority for stay of the assessment order and contend that there is no necessity to refund the same. ...

Court Having Jurisdiction Over Seat Of Arbitration Would Be Entitled To Entertain Petition U/S 34 Of Arbitration Act: Jharkhand High Court

The Jharkhand High Court bench of Justice Sanjay Kumar Dwivedi has held that the court having jurisdiction over the seat of Arbitration would be entitled to entertain a petition under section 34 of the Arbitration Act. Brief Facts: A dispute arose between the petitioner and the opposite party. An Arbitration clause was invoked. The award was also passed which was subsequently challenged before the commercial court at Ranchi under section 34 of the Act. The opposite party challenged...

Arbitral Tribunal Not Bound By Strict Rigors Of CPC, Amendment Permissible At Any Stage Of Proceedings: Jharkhand High Court

The Jharkhand High Court Bench of Justice Gautam Kumar Choudhary has held that the power under Articles 226 and 227 of the Constitution can be invoked for interfering with an interim order only in exceptionally rare cases. Additionally, the court held that Arbitral Tribunals are not bound by the strict rigours of CPC and an amendment is permissible at any stage of the proceedings for the purpose of determining the real question in controversy between the parties. Brief Facts: ...

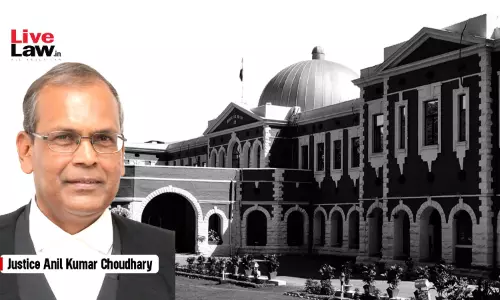

Advocate Not Liable To Verify Fake Documents Provided By Client For Firm Registration To Evade Tax: Jharkhand High Court

The Jharkhand High Court stated that an advocate is not liable to verify fake documents provided by a client for registration of a firm to evade tax.The bench of Justice Anil Kumar Choudhary was dealing with a case where an advocate had moved a petition for anticipatory bail in a case registered under sections 406/420/468/471/120B of the Indian Penal Code and under Section 132 (1) (b)/131 (1) (e)/132 (1) (1) of Jharkhand Goods and Services Tax (JGST).In this case, the petitioner who is a...

Who Qualifies As 'Proper Officer' To Issue Show Cause Notices U/S 74 Of CGST Act? Jharkhand High Court Clarifies

The Jharkhand High Court has provided a significant clarification regarding who qualifies as the “proper officer” empowered to issue a show cause notice under Section 74 of the Central Goods and Services Tax (CGST) Act, 2017. The Division Bench of Justices Sujit Narayan Prasad and Arun Kumar Rai observed that “If the definition of the Poper Officer will be taken into consideration along with the provision of Section 168 of the Act, 2017, the Commissioner if authorized to act by the...

Jharkhand High Court Quashes Criminal Proceedings For Delayed Tax Payment In Absence Of Any Penalty Proceedings

The Jharkhand High Court has quashed the criminal proceedings against a man accused of tax evasion under the Income Tax Act, 1961. The case involved allegations that the petitioner, a tractor dealer, failed to pay the tax liability associated with his income tax returns for the assessment year 2011-12, despite declaring the amount in his filing.The court's decision to quash the proceedings hinged on the fact that the tax was eventually paid, albeit with some delay, and that there were no pending...

Jharkhand High Court Dismisses Dept's Appeals For Not Filing Delay Condonation Application Along With Appeal Memo

The Jharkhand High Court, while dismissing the appeal filed by the department, held that a delayed condonation application not filed with an appeal memo and subsequent filing cannot cure defects.The bench of Chief Justice B.R. Sarangi and Justice Sujit Narayan Prasad has observed that time and again if the appeal memo does not contain an application of delay condonation and was not filed at the time of filing of the same, then even subsequent filing of the application for condonation of delay...