Jharkhand High Court

Section 11 Of Arbitration Act Mandates Examination Of Written, Signed Arbitration Clauses As Per Section 7 Requirements: Jharkhand High Court

The Jharkhand High Court bench of Acting Chief Justice Shree Chandrashekhar has held that in Section 11(6) of the Arbitration and Conciliation Act, 1996, the Court is required to see whether there is an arbitration clause which as per section 7 should be a document in writing signed by the parties. The bench held where the existence of the arbitration agreement is undisputed by the parties involved, the dispute should accordingly be referred to arbitration. Brief Facts: Tata...

Section 11 Petition Requires Only Existence of Arbitration Clause, 'No More, No Less': Jharkhand High Court

The Jharkhand High Court bench of Acting Chief Justice Shree Chandrashekhar has held that the court in Section 11 of the Arbitration and Conciliation Act, 1996 is not required to look beyond except existence of the arbitration clause at this stage; 'no more no less'. Section 11 of the Arbitration Act pertains to the appointment of arbitrators. It outlines the procedure for the appointment of arbitrators in cases where parties to an arbitration agreement are unable to agree on the...

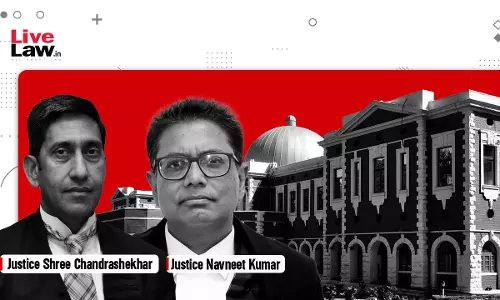

Jharkhand High Court Dismisses JUVNL's Appeal, Upholds Sole Arbitrator Appointment In Dispute With M/s Rites

The Jharkhand High Court has dismissed the appeal filed by Jharkhand Urja Vikas Nigam Limited (JUVNL) challenging the writ court's order to appoint a sole arbitrator in its dispute with M/s Rites.The Court emphasized that it is the High Court's duty to reject petitions or defenses based on purely technical grounds aimed at gaining an unfair advantage.The Division Bench, comprising Acting Chief Justice Shree Chandrashekhar and Justice Navneet Kumar, noted, “…except for a broad proposition that...

Existence Of Arbitration Clause Doesn't Automatically Bar Criminal Proceedings: Jharkhand High Court

The Jharkhand High Court bench of Justice Sanjay Kumar Dwivedi held that held that the existence of an arbitration clause does not automatically bar criminal proceedings. It held that quashing of cognizance or proceedings, as well as the initiation of arbitral proceedings related to commercial transactions, are not determinative factors. The bench held that merely because there is a remedy available for breach of contract through arbitration does not automatically lead the court to...

Refusal By JBVNL To Reimburse Contractor GST Impact On Indirect Transactions Violative Of Article 14: Jharkhand High Court

The Jharkhand High Court has held that the action of Jharkhand Bijli Vitran Nigam (JBVNL) offends Article 14 of the Constitution of India by refusing to reimburse contractor GST impact on indirect transactions.“This is a settled law that the state and its instrumentalities are required to demonstrate fair play in action. In “ABL International Ltd. and Another,"17 the Hon'ble Supreme Court observed that even in contractual matters, the state and its instrumentalities are required to follow the...

Unjust Retention Of Money Or Property Of Another Is Against Fundamental Principles And Patently Illegal: Jharkhand HC Imposes Rs 5 Lakh Penalty On JBVNL, Directs Board To Refund TDS

The Jharkhand High Court has held that any unjust withholding of money or property from another party goes against the fundamental principles of justice, fairness, and good conscience. In this context, the unauthorized deductions made from the ongoing bills are unquestionably unlawful.Furthermore, the Court has imposed a substantial penalty of Rs 5 Lacs on the Managing Director of Jharkhand Bijli Vitran Nigam Limited (JBVNL) for engaging in unnecessary litigation and presenting frivolous...

Placement Agency To Be Given Proper SCN On Alleged Failure To Perform Duties Coupled With Monetary Loss To JSBCL: Jharkhand High Court

The Jharkhand High Court has held that Rule 15 of the Jharkhand Excise (Operation of Retail Product Shops through Jharkhand State Beverages Corporation Limited) Rules, 2022, and the corresponding clauses of the contract have to be restricted only to those situations where the placement agency has been found, albeit after hearing the agency, to have failed to provide manpower to Jharkhand State Beverages Corporation Ltd. (JSBCL), which has resulted in pecuniary loss to the corporation. The bench...

Decision On A Question Of Law That Is Later Overturned Or Modified By The Superior Court In Another Case Does Not Form A Ground For Review: Jharkhand High Court

The Jharkhand High Court has recently clarified the criteria for reviewing judgments in tax appeal cases, particularly regarding decisions based on legal questions. According to the explanation to Rule 1 of Order 47 of the Code of Civil Procedure, the court stated that if a decision on a legal question forming the basis of a court judgment is later reversed or modified by a higher court in a different case, it cannot be used as grounds for reviewing the original judgment. The case centered...

Jharkhand High Court Allows Application for Revocation of Cancelled GST Registration Despite Expiry of Limitation Period

In a recent ruling, the Jharkhand High Court has permitted the filing of an application for revocation of cancelled GST registration, despite the expiration of the limitation period. The decision stemmed from a petition filed by a proprietor aggrieved by the dismissal of their petition under section 107 of the Central Goods and Services Tax Act, 2017 (GST Act). The petitioner sought to avail themselves of the option under section 30 of the GST Act for revocation of the cancellation of...

Issuance Of Pre-SCN Consultation Is Mandatory Requirement For Issuing SCN Under Customs Act, 1962: Jharkhand High Court

The Jharkhand High Court has held that the issuance of pre-SCN consultation is mandated under proviso to Section 28(1)(a) of the Customs Act, 1962, before issuing the show cause notice.The bench of Justice Rongon Mukhopadhyay and Justice Deepak Roshan has observed that the mandatory pre-SCN consultation, as mandated under proviso to Section 28(1)(a) of the Customs Act, 1962, read with the Pre-Notice Consultation Regulation, 2018, was not complied with while issuing the impugned SCNs; hence, the...

Person Who Assists With Proceeds Of Crime May Be Prosecuted Under PMLA Though Not Booked For Existing Scheduled Offence: Jharkhand High Court

The Jharkhand High Court has observed that individuals implicated in a PMLA (Prevention of Money Laundering Act) case, who become involved after the commission of the scheduled offense by aiding in the concealment or utilization of proceeds of crime, are not required to be accused in the scheduled offense. The court emphasized that these individuals can still face prosecution under PMLA as long as the scheduled offense remains valid.Justice Sujit Narayan Prasad observed that, “...an accused in...

Reopening Notice Issued U/s 148 Merits To Be Quashed If Barred By Limitation Period Prescribed U/s 149: Jharkhand High Court

Finding that the notice issued u/s 148 is barred by the limitation period prescribed u/s 149 of the Income tax Act, 1961, the Jharkhand High Court (Ranchi Bench) ruled that the very initiation of reassessment proceeding is wholly without jurisdiction. The Division Bench of Justice Rongon Mukhopadhyay and Justice Deepak Roshan observed that “The three-year time period of A.Y 2016-17 had ended on 31.03.2020. Accordingly, the Impugned Notice, dated 21.07.2022, is beyond 3 years' time period....