High Courts

S.238 IBC Is Non-Obstante Clause, Overrides Provisions Of Electricity Act: Allahabad High Court

The Allahabad High Court has held that the Insolvency and Bankruptcy Code, 2016 overrides the provisions of Electricity Act, 2003 read with Electricity Supply Code, 2005.A bench of Justice Arindam Sinha and Justice Prashant Kumar held“Section 238 of Insolvency and Bankruptcy Code, 2016 is a non- obstante clause meaning it grants the IB Code a power of overriding effect on other laws, for the time being in force, or any instrument that is inconsistent with it. This is a Special Section, which...

SARFAESI Act | Lending Banks Only Obligated To Consider Revival Scheme For NPA MSMEs If Borrower Claims Relief U/S 13(3A): Bombay High Court

The Bombay High Court bench, comprising Justice Suman Shyam and Justice Manjusha Deshpande, has held that the lending bank is obligated to consider the MSME revival scheme for classification of account as NPA only if it has been claimed by the MSME in response to the demand notice under Section 13(3A) of the SARFAESI Act. The petitioner's MSME unit took certain loans from ICICI Bank and the Technology Development Board (TBD). The ICICI Bank classified its account as NPA on February...

NCLT Has Jurisdiction U/S 60(5)(C) IBC To Adjudicate Lease Disputes In Liquidation Proceedings: Gujarat High Court

The Gujarat High Court bench led by Justice Niral R. Mehta held that the NCLT has jurisdiction under section 60(5)(c) of the IBC to adjudicate the lease and license dispute during the liquidation proceedings. The petitioners, Fivebro Water Services Pvt. Ltd. and another, had the lease and license agreements with the corporate debtor for its premises in Ahmedabad and Mumbai. Thereafter, the liquidation of the corporate debtor was ordered. The liquidator filed an application...

Cheque Dishonour Proceedings Can Be Sustained Against Directors & Signatories Of Company Even If It Is Declared Insolvent: Orissa High Court

The Orissa High Court, Bench comprising Justice Chittaranjan Dash, has ruled that the proceedings under section 138 of the NI Act will sustain against the directors or signatories of the company even if the entity has been declared insolvent under the IBC, 2016. The complainant extended a loan of Rs. 1 Cr. to Zenith Mining Pvt. Ltd., which remains unpaid. The check issued by the respondent was dishonored twice with the remark 'refer to drawer.' These events led the complainant to...

"Insolvency Professionals Acting Like Scavengers Must Be Dealt With Severely": Delhi High Court Slams Practitioner's Misconduct

The Delhi High Court recently slammed the conduct of a senior insolvency professional, warning that such individuals must not become “predators” of companies already in financial distress. In a scathing judgment, the Court said professionals under the Insolvency and Bankruptcy Code (IBC) must uphold the highest ethical standards and 'even a single act of negligence' is sufficient for a disciplinary actionThe judgment, delivered by Justice Subramonium Prasad on September 9, contained strong...

Civil Courts Cannot Grant Ex-Parte Injunction In Shareholder Disputes Due To Bar U/S 430 Companies Act: Calcutta High Court

The Calcutta High Court bench presided over by Justice Aniruddha Roy, has observed that a civil court cannot grant an ex parte ad interim injunction in a shareholder dispute, in light of the bar under section 430 of the Companies Act, 2013. The plaintiff filed a civil suit before the Civil Judge, Senior Division, Alipore, alleging that his shares in the Power Tools and Appliances Co. Pvt. Ltd. had been illegally reduced, usurping his control over the company. The court passed an...

Arbitral Proceedings Cannot Continue Once Moratorium Under IBC Is In Effect, Creditors' Recourse Lies Before Liquidator: Madras High Court

The Madras High Court bench of Justice N. Anand Venkatesh held that arbitration proceedings cannot continue after commencement of liquidation, any order passed thereafter is not legally sustainable. However, considering that continuation of arbitration proceedings would be futile and that the petitioner had not been informed of the commencement of the liquidation, the court allowed the petitioner to file its claim before the liquidator. Background: M/s. AL Tirven Steels Ltd. had...

Under SARFAESI & RDB Acts, Dues Of Secured Creditors Take Precedence Over Govt Dues: Allahabad High Court

The Allahabad High Court has held that under Section 26-E of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 and Section 31B of the Recovery of Debts and Bankruptcy Act, 1993, the debts of the secured creditors will take precedence over all over debts including crown debts.The bench of Justice Shekhar B. Saraf and Justice Praveen Kumar Giri held “Upon a perusal of the judgments cited above, the first principle that emerges is that a...

Tax Demands Raised Post Approval Of IBC Resolution Plan Are Not Enforceable: Karnataka High Court

The Karnataka High Court recently reiterated that tax demands raised by revenue authorities after the approval of a resolution plan under the Insolvency and Bankruptcy Code (IBC) are unenforceable if the claims were not submitted during the Corporate Insolvency Resolution Process (CIRP).A single bench of Justice M Nagaprasanna observed,“There is no jurisdiction to parallelly initiate proceedings and raise a demand. In the light of CIRP becoming moratorium kicking in resolution plan...

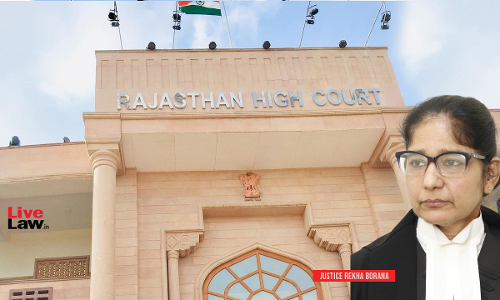

Bank Can Assign Debt Even If NPA Classification Is Later Declared Invalid: Rajasthan High Court

The Rajasthan High Court dismissed a writ petition filed against SBI's assignment of debt in favor of Alchemist Asset Reconstruction Company Ltd. (AARC) holding that even if NPA classification is later declared invalid, it does not affect the validity of assignment of debt. Justice Rekha Borana held that “the assignment cannot be invalidated merely because the NPA classification was later declared invalid. The writ petition being totally misconceived does not deserve any interference...

SARFAESI Charge Created Before GST Charge Takes Precedence Over It: Karnataka High Court

'If a claim is made under the IBC Act and there is no claim under the SARFAESI Act, RDB Act, or GST Act, the claim under the IBC Act can be implemented without issue. Similarly, if a claim is made under the GST Act and there are no claims under the SARFAESI Act, RDB Act, or IBC Act, the claim under the GST Act can be executed without difficulty'

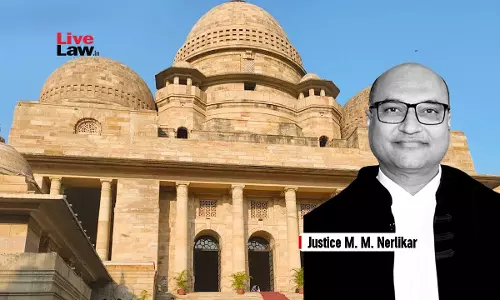

Prior IBC Proceedings Don't Bar Criminal Prosecution Of Directors Under S. 138 Negotiable Instruments Act: Bombay High Court

The High Court of Bombay, Nagpur Bench, comprising Justice M.M. Nerlikar, has held that the prior initiation of IBC proceedings does not bar criminal prosecution of directors under section 138 of the Negotiable Instruments Act. Background of the Case The petitioner extended a short-term loan of Rs. 15 lakhs to the respondent through its directors. A post-dated cheque was issued as a security by the director. The NCLT admitted the respondent company into the CIRP, and its failure ...