INCOME TAX

Income Tax Act | Criminal Complaint For Tax Evasion Filed During Pendency Of Reassessment Proceedings Not Premature: Delhi High Court

The Delhi High Court recently dismissed a plea for quashing a criminal complaint lodged under Income Tax Act 1961 for alleged tax evasion, moved on the ground that reassessment action was pending and hence the complaint was premature.The bench of Justice Neena Bansal Krishna cited P. Jayappan vs. S.K. Perumal, First Income Tax Officer [1984] where it was held that pendency of...

Income Tax Act | Supreme Court Delivers Split Verdict On Timelimit For Assessments Under S.144C

The Supreme Court on Friday (Aug. 8) delivered a split verdict on the interpretation of the limitation period under Section 144C of the Income Tax Act, 1961 (“Act”), governing the timeline for passing assessment orders by the Assessing Officer in cases involving eligible assessees, such as foreign companies and transfer pricing matters.The judgment was delivered by the bench of Justices...

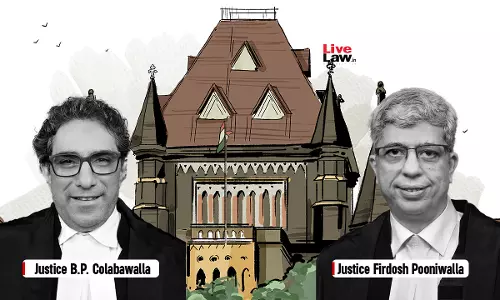

Income Tax | S.194C & S.194LA Would Not Apply When TDR Certificates Are Issued In Lieu Of Compensation: Bombay High Court

The Bombay High Court held that Section 194C and Section 194LA of the Income Tax Act would not apply when TDR Certificates are issued in lieu of compensation. Justices B.P. Colabawalla and Firdosh P. Pooniwalla agreed with the assessee that the words “or by any other mode” appearing in Section 194C would have to be read ejusdem generis to the words “payment thereof in cash or...

Stock Exchange & Banking Channels Cannot Mask Sham Transactions Carried Out Through Bogus Capital Loss Claim Companies: Calcutta High Court

The Calcutta High Court held that stock exchange and banking channels cannot mask sham transactions carried out through bogus capital loss claim companies. Justices T.S. Sivagnanam and Chaitali Chatterjee (Das) observed that “the entire information contained in the investigation report was apprised to the assessee by the assessing officer and thereafter the show cause notices...

Mere Incorporation Of Investing Companies Under Companies Act Not Enough To Prove Genuineness Of Share Transactions: Calcutta High Court

The Calcutta High Court held that mere incorporation of investing companies under the Companies Act is not enough to prove the genuineness of share transactions. The bench opined that, admittedly, the shares were by way of a private placement. Though the investing companies might have been incorporated under the provisions of the Company's Act, that by itself will not...

Income Tax | Sale Proceeds Of One House Used For Purchasing Multiple Residential Houses Qualifies For Exemption U/S 54(1): Bombay High Court

The Bombay High Court held that sale proceeds of one residential house, used for purchase of multiple residential houses, would qualify for exemption under Section 54(1) of the Income Tax Act. The issue before the bench was whether Section 54(1) of the Income Tax Act allows the Assessee to set off the purchase cost of more than one residential units against the capital gains earned...

Burden To Prove That Best Assessment By Income Tax Authorities Is Perverse Is On Assesee: Allahabad High Court

The Allahabad High Court has held that the burden to prove that the findings of best assessment done by the authorities is perverse is on the assesee. The bench of Justice Shekhar B. Saraf and Justice Praveen Kumar Giri held that “when a best assessment is done, it is for the assessee to bring on record the facts that may reveal that the findings are perverse in...

Foreign Entity Doing Business Through Temporary Premises In India Liable To Tax : Supreme Court Rejects Hyatt International's Appeal

The Supreme Court on Thursday (July 24) ruled that the existence of a Permanent Establishment (PE) is sufficient to attract tax liability for a foreign entity in India, even in the absence of exclusive possession of a fixed place of business. The Court clarified that temporary or shared use of premises, when combined with administrative or operational control, is adequate to establish a...

Unauthenticated Documents From Foreign Govt Regarding Swiss Bank Account Of Assessee Can't Form Basis For Criminal Action: Delhi HC

The Delhi High Court has quashed the criminal proceedings initiated against an assessee under Section 276C, 276D and 277 of the Income Tax Act 1961 merely on the basis of some unauthorised documents alleging existence of an undisclosed Swiss Bank account in his name.In doing so, Justice Neena Bansal Krishna observed,“Merely on some unauthenticated information received from a third Country...

ITAT Rejects Congress Party's Appeal To Exempt ₹199.15 Crore From Income Tax, Cites Belated Filing Of Return

The Income Tax Appellate Tribunal dismissed an appeal by the Indian National Congress seeking income tax exemption for the income of ₹199.15 crore during the assessment year 2018-19.The Tribunal rejected the party's claim for exemption on the ground that there was a violation of the conditions in Section 13A of the Income Tax Act. The returns were filed late, the ITAT noted. Calling for...

Income Tax | Salary Received By Chinese Resident For Services In China Not Taxable In India, Even If Credited To Indian Bank Account: ITAT

The Chennai Bench of Income Tax Appellate Tribunal (ITAT) has stated that salary received by Chinese resident for the services in China not taxable in India, even if credited to the Indian bank account. Manu Kumar Giri (Judicial Member) and S.R. Raghunatha (Accountant Member) observed that “the AO has disallowed the exemption claimed with respect to salary received in India...

Notice U/S 153C Income Tax Act Can Be Issued Only If Incriminating Material Has 'Bearing On Total Income' Of Non-Searched Assessee: Delhi HC

The Delhi High Court has made it clear that assessments under Section 153C of the Income Tax Act, 1961 can be made on a non-searched entity only when the Assessing Officer has incriminating material which “has a bearing” on its total income.Section 153C allows the Revenue department to proceed against a party other than the person who is being searched, if incriminating articles belonging...