INCOME TAX

AO Can Determine Annual Value Of Property Higher Than Municipal Rateable Value U/S 22 Income Tax Act: Bombay High Court

The Bombay High Court stated that the assessing officer (AO) can determine the annual value of the property higher than the municipal rateable value under Section 22 of the Income Tax Act. Section 22 of the Income Tax Act, 1961 deals with the "taxability of 'Income from House Property”. It says the annual value of property consisting of any buildings or lands appurtenant thereto...

Cash Deposits During Demonetisation Not 'Unexplained Money' If Traceable To Previous Year's Balance: Chhattisgarh High Court

The Chhattisgarh High Court held that cash deposits during demonetisation are not unexplained money if traceable to previous year's balance. Section 69 of the Income Tax Act, 1961 requires the assessee to provide proof of income and provide a proper explanation of the source of such unexplained income. Justices Sanjay K. Agrawal and Deepak Kumar Tiwari stated that the factum...

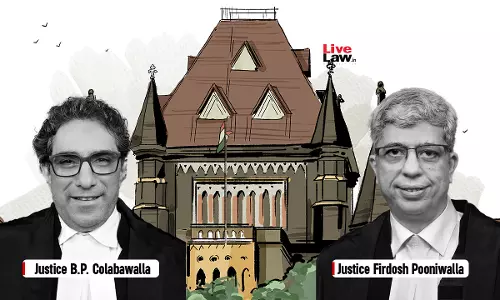

Income Tax | Interest On Fixed Deposits, TDS Refund Linked To Business Qualifies For S. 80IA Deduction: Bombay High Court

The Bombay High Court held that interest on fixed deposits, TDS refund linked to business qualifies for deduction under Section 80IA of the Income Tax Act. Section 80IA of the Income Tax Act, 1961 provides tax incentives for businesses operating in certain sectors such as infrastructure, power, and telecommunications. Justices B.P. Colabawalla and Firdosh P. Pooniwalla...

Supreme Court Pulls Up Income Tax Dept For Launching Prosecution For Tax Evasion Without ITAT Confirmation, Imposes Rs 2 Lakh Cost

The Supreme Court on Thursday (Aug. 28) imposed Rs. 2 Lakhs cost on Income Tax Department for 'grossly abusing its position' to continue a prosecution against an assessee alleging willful tax evasion.The bench comprising Justices JK Maheshwari and Vijay Bishnoi set aside the Madras High Court's decision, which refused to quash the prosecution case initiated by the department. The Court...

Wedding Gifts Can't Be Automatically Treated As 'Unexplained Income' Without Evidence: ITAT

The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) has stated that wedding gifts can't be automatically treated as unexplained income without evidence. Dr. BRR Kumar (Vice President) and Siddhartha Nautiyal (Judicial Member) stated that the fact that marriage gifts were received prior to the date of marriage itself could not lead to the conclusion that the same are not...

Property Transfer Between Spouses Without Actual Consideration Not Taxable As Capital Gains: ITAT

The New Delhi Bench of Income Tax Appellate Tribunal (ITAT) has stated that property transfer between spouses without actual consideration is not taxable as capital gains. S. Rifaur Rahman (Accountant Member) and Anubhav Sharma (Judicial Member) were dealing with the issue arises out of addition of Rs. 1,40,00,000/-, being consideration amount mentioned in conveyance deed, executed...

S.263 Income Tax Act | Commissioner Cannot Revise Assessment Merely Because Detailed Reasoning Was Not Given: Madras High Court

The Madras High Court stated that the Income Tax commissioner cannot revise an assessment merely because detailed reasoning was not given in the order. Section 263 of the Income Tax Act, 1961, empowers the Commissioner of Income Tax to revise any order passed under the Income-tax Act, 1961, “the Act” which is erroneous insofar as it is prejudicial to the interest of...

Income Tax Act | Rebate U/S 87A Available On Short-Term Capital Gains U/S 111A Under New Regime: ITAT

The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) has stated that rebate under section 87A available on short-term capital gains under section 111A under new regime. Suchitra R. Kamble (Judicial Member) and Makarand V. Mahadeokar (Accountant Member) stated that on a plain reading of the statutory provisions, there exists no express bar either in section 87A or section 111A...

Income Tax | Sale Proceeds Of Vintage Cars Taxable Unless Assessee Proves That Car Was Used As Personal Asset: Bombay High Court

The Bombay High Court held that sale proceeds of vintage car taxable unless the assessee proves that the car was used as a personal asset. Chief Justice Alok Aradhe and Justice Sandeep V. Marne stated that the capability of a car for personal use would not ipso facto lead to automatic presumption that every car would be personal effects for being excluded from capital assets of...

Is Merchant Navy Officer's Salary Credited In Indian Bank Account Exempt From Income Tax? Supreme Court To Decide

The Supreme Court on Monday (Aug. 18) agreed to decide whether the income credited in an Indian bank account while working with a Foreign Entity would be exempted from the payment of Income Tax under the Income Tax Act, 1961.. The issue arose before the bench of Justices Pankaj Mithal and Prasanna B. Varale while hearing the appeal filed against the Punjab & Haryana High Court's...

Widow Eligible To Claim TDS Credit On Deceased Husband's Income: ITAT

The Kolkata Bench of Income Tax Appellate Tribunal (ITAT) has stated that widow eligible to claim TDS credit on deceased husband's income. Sonjoy Sarma (Judicial Member) and Rakesh Mishra (Accountant Member) stated as per sub-rule (2) of Rule 37BA and sub-rule 3(i) of the Income Tax Rules, 1962, if the income is assessable in the hands of any other person, the credit of TDS shall...

Income Tax | Interest Earned On Surplus Lending Funds Is Attributable To Banking Business, Qualifies For 80P Deduction: Calcutta High Court

The Calcutta High Court stated that interest earned on surplus lending funds is attributable to banking business, qualifies for 80P deduction under Income Tax Act. Section 80P of the Income Tax Act, 1961 provides 100% tax deductions to cooperative societies for income from specified activities. These activities commonly include marketing agricultural produce, purchasing...