High Court

Service Tax | Pairing & Testing Smart-Cards For Set-Top-Boxes Qualifies As Job Work: Bombay High Court Allows Credit

The Bombay High Court has upheld the Mumbai Tribunal's decision allowing Dish TV to retain CENVAT Credit on imported smart cards, which were used for testing and pairing with Set Top Boxes. A Division Bench comprising, Justice Vibha Kankanwadi and Justice Hiten S. Venegavkar dismissed the appeal filed by the Service Tax Department against order by the Mumbai, Customs, Excise and Service Tax Appellate Tribunal (CESTAT) that after verifying accounting records held in favour of Dish TV....

Service Tax | Windmill Installation, Commissioning Services Construable As 'Input Service', Credit Admissible: Gujarat High Court

The Gujarat High Court has allowed CENVAT credit of service tax paid on input used in setting up of a Windmill, away from factory premises, on the strength of nexus of the inputs with output activity, electricity generation. A Division Bench comprising, Justice Bhargav D. Karia and Justice Pranav Trivedi in twin writ petitions has set aside order of CESTAT Ahmedabad that disallowed CENVAT credit on the ground that credit of inputs and input services utilized away from the factory site...

Service Tax Refund Cannot Be Denied On Limitation When Deposit Was Made During Investigation: Chhattisgarh High Court

The Chhattisgarh High Court has held that service tax deposited during the course of investigation cannot be denied refund merely on the ground of limitation under Section 102(3) of the Finance Act, 1994, especially when the department itself later drops proceedings and acknowledges non-liability. The Division Bench of Justice Rajani Dubey and Justice Amitendra Kishore Prasad allowed a tax appeal filed by a service tax assessee challenging the rejection of a refund claim amounting to...

Service Tax | Once Pre-Deposit Condition Is Fulfilled, Appeal Must Be Heard On Merits: Jharkhand High Court

The Jharkhand High Court held that once an appeal was dismissed for non-compliance with the mandatory pre-deposit of the Service Tax amount, the Appellate Authority does not become functus officio and was competent to decide the appeal on merits if the mandatory condition of pre-deposit of 7.5% of the Service Tax amount was subsequently complied with by the assessee. A Division Bench comprising of Chief Justice and Justice Rajesh Shankar, stated that the appeal at the earlier occasion...

Information Regarding GST Returns Of Company Cannot Be Disclosed Under RTI Act: Bombay High Court

The Bombay High Court on Tuesday (October 14) held that a company's Goods and Services Tax (GST) returns filing cannot be disclosed under the Right To Information (RTI) Act. Sitting at Aurangabad bench, single-judge Justice Arun Pednekar noted that section 158(1) of the GST Act prohibits disclosure of information of GST returns to third parties and that section 8(1)(j) of the RTI Act too exempts certain information from being made public unless the information officer is satisfied that the...

Officer Appointed Under State GST Act Is Authorised To Discharge Duties As Proper Officer For IGST & CGST: Allahabad High Court

The Allahabad High Court has held that an officer appointed under the State Goods & Service Tax Act will be Proper Officer under the Integrated Goods & Service Tax Act as well as the Central Goods & Service Tax Act. Perusing Section 4 of the IGST Act read with rule 20 of the CGST Act, Justice Piyush Agrawal held that “The provision provides that the Officer appointed under the State Goods & Service Tax is authorized to discharge their duties as Proper Officer for the...

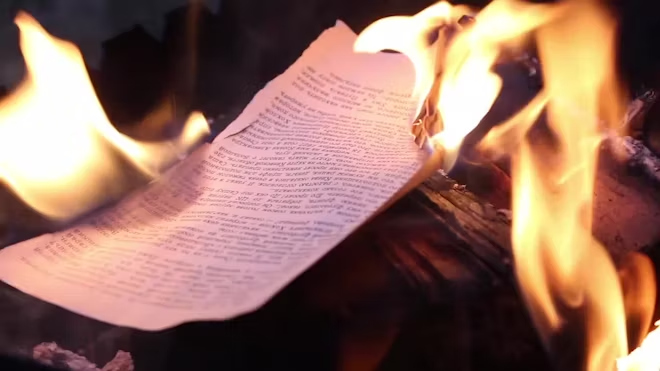

Patna High Court Upholds ₹25 Lakh Service Tax Demand Against Travel Agency Which Failed To Disclose Transactions & Claimed Records Were Lost In Fire

The Patna High Court has recently upheld a service tax demand of ₹25.25 lakh against a travel agency, dismissing its defence that crucial business records had been lost in a fire. The Division Bench comprising Justice Rajeev Ranjan Prasad and Justice Ashok Kumar Pandey observed, “this petitioner having surrendered his service tax registration had not disclosed the transactions in ST-3. The Taxing Authority were not aware of this, they were looking for cooperation on the part of the petitioner,...

Lawyers Running Individual Practice Exempt From Levy Of GST, Service Tax: Orissa High Court

The Orissa High Court has reminded the GST and Service tax authorities not to harass practicing lawyers by issuing them notices for levy of GST or service tax.A Chief Justice Harish Tandon and Justice BP Routray thus quashed the notices issued to a Bhubaneswar based lawyer demanding service tax of Rs.2,14,600/- and penalty of Rs.2,34,600/- plus interest.It observed, “in view of the admitted fact that the Petitioner is a practicing lawyer…the Department the Petitioner is exempted from levy of...

Finance Act, 1994 | Mere Non-Registration Under Service Tax Isn't Fraud Or Suppression To Justify 5 Year Limitation: Patna High Court

The Patna High Court has recently quashed a service tax demand raised against a government contractor, ruling that merely not registering for service tax could not be equated with fraud or suppression of facts warranting the application of the five-year extended limitation period under the Finance Act, 1994.The Division Bench comprising Justice Rajeev Ranjan Prasad and Justice Sourendra Pandey, observed, “the plea of the respondent that the petitioner had not taken registration of the service...

Short Tax | Timeline For Issuing Show Cause Notice U/S 73(2) Is Mandatory, Not Discretionary: Andhra Pradesh High Court

The Andhra Pradesh High Court has held that the time permit set out under 73(2) of the AP GST Act for issuance of show cause notice in relation to alleged short payment of tax, etc. is mandatory in nature.A division bench of Justices R Raghunandan Rao and Harinath N. added that any violation of that time period cannot be condoned and would render the show cause notice otiose.It observed, “The GST Act, has put in place certain protections for tax payers. One of the primary protections is that...

Service Tax Liability Cannot Be Fastened On Implementation Of Govt Projects: Calcutta High Court

The Calcutta High Court has held that construction of canals/ pipelines/ conduits to support irrigation, water supply or for sewerage disposal, when provided to the Government, cannot be exigible to service tax. A division bench of Chief Justice TS Sivagnanam and Justice Hiranmay Bhattacharyya relied on two Circulars issued by the Central Board of Indirect Taxes and Customs to observe, “Even in case of works contract, if the nature of the activities is such that they are excluded from...

Charitable Society Looking After Socio-Economic And Welfare Matters Of Ex-Servicemen, Their Families Can Levy Service Tax: Kerala HC

The Kerala High Court stated that services by charitable society who look after socio-economic and welfare matters of ex-serviceman and their families is liable to service tax. The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. observed that “for an association like the assessee, the embarking on a transaction that is designed to earn income for its members, would have to be seen as a commercial venture and the assessee who embarks on such a venture, a ...