High Court

Service Tax Not Prima Facie Leviable On Amounts Claimed As Performance Linked Incentives/Commission: Delhi High Court

The Delhi High Court has prima facie observed that service tax is not leviable on amounts claimed by an Assessee as commission or performance linked benefit. A division bench of Justices Yashwant Varma and Dharmesh Sharma cited the decision of a Larger Bench of the CESTAT in Kafila Hospitality & Travels Pvt. Ltd. vs. Commr. Of S.T., Delhi (2023). In that case, the Tribunal dealt with the issue of whether the incentives paid by airlines to travel agents for achieving targets was ...

Laying Down Optical Fibre Cables To Enhance Communication Network For Defence Forces Is Exempt From Service Tax: Delhi High Court

The Delhi High Court recently declared that Telecommunications Consultants India Limited, a central public sector undertaking which secured a Project floated by BSNL for laying down Optical Fibre Cable Network, is exempt from service tax since the service is in the nature of setting up a civil infrastructure so as to benefit the defence forces in having a better communication network. A division bench of Justices Yashwant Varma and Dharmesh Sharma observed, “The said services are...

[S.74 GST Act] Adjudicating Authority Must Record Prima Facie Satisfaction Regarding Assessee Wrongfully Obtaining Input Tax Credit: Allahabad HC

The Allahabad High Court has held that for initiating proceedings under Section 74 of the Goods and Service Tax Act, 2017, it is necessary for the adjudicating authority to record prima facie satisfaction regarding the assessee having wrongfully availed input tax credit (ITC) by fraud, willful misstatement or suppression of facts. The Court held that once the proceedings under Section 73 have been closed regarding wrongful availment of ITC, proceedings for the same cannot be initiated...

Arbitral Tribunal Acted With Patent Illegality, Against Indian Law In Awarding Reimbursement Of Service Tax Along With Interest: Calcutta High Court

The Calcutta High Court Bench of Justice Sabyasachi Bhattacharyya observed that award passed by Arbitral Tribunal was tainted with patent illegality and contravened the fundamental policy of Indian law. The award was challenged under section 34 of the Arbitration and Conciliation Act (act). The court set aside the award in which South Eastern Railway (railway) was directed to reimburse the respondent towards service tax and interest. Brief Facts The dispute emerged from the contract...

Second Provisional Attachment Notice Lacking Fresh Reasons Is Arbitrary: Allahabad High Court

The Allahabad High Court stated that issuing a second provisional attachment notice without providing new or fresh reasons is considered arbitrary. The Division Bench of Justices Shekhar B. Saraf and Manjive Shukla observed that “the department cannot be allowed simpliciter to issue a second notice, and thereafter, third and fourth and continue with the provisional attachment for four to five years without giving any fresh reason for the said provisional attachment. If the same was...

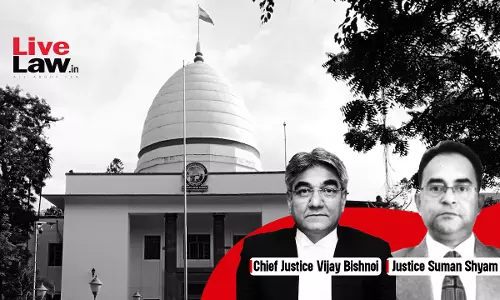

No Element Of Misstatement And Intention To Evade Payment Of Service Tax: Gauhati High Court Quashes Demand & Penalty

Finding that the Assessee company had provided every detail regarding availment of CENVAT Credit in the ST-3 Returns, and the same was considered by the Central Excise Commissioner, the Gauhati High Court held that the fact of wilful misstatement or suppression should specifically be mentioned in the show-cause notice. Since the Department had not misstated any fact with intent to evade the payment of service tax, the Division Bench of Chief Justice Vijay Bishnoi and Justice Suman...

Tax Invoice, E-Way Bill, GR Or Payment Details Not Sufficient To Prove Physical Movement Of Goods: Allahabad High Court Upholds Penalty U/S 74 GST

Recently, the Allahabad High Court has held that production of tax invoice, e-way bill, GR or payment details is not sufficient to show the actual physical movement of the transaction for the purposes of availing Input Tax Credit under Section 16 of the Goods and Service Tax Act, 2017. Section 16 of the Goods and Service Tax Act, 2017 provides for the conditions and eligibility for claiming input tax credit. Section 16(2) provides that an assesee is not entitled any input tax credit...

Goods In Transit Without Documents, Can Survey Business Premises To Find Correctness Of Transaction: Allahabad High Court

The Allahabad High Court has held that if the goods in transit are not accompanied by proper documentation, including e-way bill, the authorities can survey the business premises of the assesee to determine the correctness of the transaction. However, it was held that if the e-way bill was produced before passing of seizure order under Section 129 of the Goods and Service Tax Act, 2017, then contravention of the Act or Rules thereunder could not be claimed by the Department. While...

Order Under S. 73 GST Can't Be Passed Against Company In Corporate Insolvency Resolution Process: Allahabad High Court

The Allahabad High Court has held that order Section 73 of the Goods and Service Tax Act, 2017 cannot be passed a company which is under the Corporate Insolvency Resolution Process (CIRP) under the Insolvency and Bankruptcy Code, 2016. Section 73 of the Goods and Service Tax Act, 2017 empowers a proper officer to initiate proceedings if he is satisfied that any tax has not been paid or short paid or erroneously refunded, or where input tax credit has been wrongly availed or utilised...

University Income From Rentals, Not Exempted From Service Tax: Karnataka High Court

The Karnataka High Court has held that the university is liable to pay service tax on the income earned from the rentals of buildings leased or licensed for banking facilities.The bench of Justice Krishna S. Dixit and Justice Ramachandra D. Huddar has observed that when the university rents out its property for running a bank, the profit motive is abundant. It is not the case of the university that the banking services are agreed to be provided on a 'no profit, no loss basis' by prescribing a...

Jharkhand High Court Sets Aside Demand Notice For Payment Of Service Tax On Legal Services Provided By A Senior Advocate

The Jharkhand High Court on Thursday quashed a demand notice issued by the tax authorities to a Senior Advocate seeking payment of service tax on legal services provided by him to a legal firm.The bench of Chief Justice Ravi Ranjan and Justice Sujit Narayan Prasad, however, did not allow the prayer seeking to quash Notification No.18/2016-ST dated 1.3.2016 and Notification No. 9/2016-ST dated 1.3.2016 issued by the tax authorities to the extent that it sought to recover service tax directly from...

Officers Of DGGI Are "Central Excise Officers"; Can Issue Show Cause Notices And Adjudicate Service Tax Demand: Madras High Court

The Madras High Court has ruled that officers of the Directorate General of GST Intelligence (DGGI) are "Central Excise Officers" for the purpose of Rule 3 of the Service Tax Rules, 1994 since they are vested with the powers of Central Excise Officers by the Central Board of Excise and Customs (CBEC). The Single Bench of Justice C. Saravanan, while considering a bunch of writ petitions, held that that the definition of "Central Excise Officer" in Section 2(b) of Central Excise Act, 1944...

![[S.74 GST Act] Adjudicating Authority Must Record Prima Facie Satisfaction Regarding Assessee Wrongfully Obtaining Input Tax Credit: Allahabad HC [S.74 GST Act] Adjudicating Authority Must Record Prima Facie Satisfaction Regarding Assessee Wrongfully Obtaining Input Tax Credit: Allahabad HC](https://www.livelaw.in/h-upload/2024/09/10/500x300_560291-justice-shekhar-b-saraf-and-justice-manjive-shukla-allahabad-high-court.webp)