Tax

Tax Weekly Round-Up: February 03 - February 09, 2025

SUPREME COURTIncome Tax Act | Offence Committed Before Show-Cause Notice Compoundable As Covered By 'First Offence' In Compounding Guidelines: Supreme CourtCase title: VINUBHAI MOHANLAL DOBARIA Vs CHIEF COMMISSIONER OF INCOME TAXCase no.: SPECIAL LEAVE PETITION (C) NO. 20519 OF 2024The Supreme Court on January 7 set aside the Gujarat High Court's judgment dated March 21, 2017, through which the rejection to the compounding application of the Appellant for the assessment year 2013-2014, for...

Imposition Of Conditions By Customs For Provisional Release Of Seized Goods 'Discretionary': Delhi HC Tunes Down 130% Bank Guarantee

The Delhi High Court has held that the imposition and severity of conditions imposed by the Customs Department for permitting provisional release of seized goods is “discretionary” in nature.In doing so, a division bench of Justices Prathiba M. Singh and Dharmesh Sharma scaled down the alleged onerous condition imposed on an importer, for executing a Bank Guarantee of 130% of the deferential duty.It observed, “The calculated amount for the bank guarantee would be substantial and may almost...

Tax Monthly Digest: January 2025

SUPREME COURTMotor Accident Claims - Tax Returns Can Be Accepted To Determine Income Only If They Are Appropriately Produced : Supreme CourtCase name: New India Assurance Co. Ltd. V. Sonigra Juhi Uttamchand.Case no.: SLP (C) No. 30491 of 2018The Supreme Court, recently (on January 02), while deciding a motor accident compensation claim case, observed that monthly income could be fixed after taking into account the tax returns. However, the details of tax payment must be properly brought into...

Income Tax Act | Offence Committed Before Show-Cause Notice Compoundable As Covered By 'First Offence' In Compounding Guidelines: Supreme Court

The Supreme Court on January 7 set aside the Gujarat High Court's judgment dated March 21, 2017, through which the rejection to the compounding application of the Appellant for the assessment year 2013-2014, for having filed the belated income tax return, was upheld on the ground that only for the "first offence" compounding of offence is possible. Since the Appellant had filed delayed income tax for 2011-2012 and his compounding application was accepted, it now cannot be accepted.However,...

Not An Enabling Provision, Proscribes Reassessment Action Beyond Limitation: Delhi HC Explains Timelines U/S 149 Of Income Tax Act

The Delhi High Court has made it clear that Section 149 of the Income Tax Act, which prescribes a limitation period for initiating reassessment against an assessee, is not an enabling provision but rather a proscription on the Assessing Officer's powers.A division bench of Acting Chief Justice Vibhu Bakhru and Justice Tushar Rao Gedela observed,“The opening sentence of Section 149(1) of the Act clearly indicates that the time limit as prescribed under Section 149(1) of the Act is a hard stop....

Direct Tax Annual Digest 2024: Part II

Cash-In-Hand Out Of Business Profits Declared In Return U/s 44AD, Can't Be Plainly Added As Unexplained Money: Delhi ITATWhile allowing the appeal against the addition on account of unexplained money, the New Delhi ITAT held that if the assessee's contention is that it had turnover exceeding the limit u/s 44AD of the Income Tax Act, then CIT(A) ought to have acted in accordance with law. The Bench comprising of Kul Bharat (Judicial Member) observed that, “If the assessee's contention is that it...

Superannuation Fund | Limit On Deduction Of Employer's Contribution Applies To Initial/ Annual Contribution, Not Additional Payments: Delhi HC

The Delhi High Court has held that the limit prescribed under Section 36(1)(iv) of the Income Tax Act 1961, on deductions that an employer can seek for contributions made towards superannuation funds, applies only at the stage of setting up the fund or making ordinary annual payments.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar said any contribution made additionally in discharge of an overarching obligation would not be rendered as a disallowable expense.It thus...

Direct Tax Annual Digest 2024: Part I

ITAT Deletes Additions Against Unsuspecting Investor In A 'Penny Stock' To Make Quick ProfitThe Mumbai Bench of Income Tax Appellate Tribunal (ITAT) has held that the assessee was an unsuspecting investor who transacted in a 'penny stock' with a view to earning a quick profit, and since his involvement in any dubious transaction relating to price rigging or connection with exit providers could not be shown, the transaction could not be treated as a 'pre-arranged' one even if there were no...

Baggage Rules Apply Only To Luggage Of International Travellers, Not To 'Reasonable Amount' Of Jewellery Worn In-Person: Madras HC

The Madras High Court has made it clear that Baggage Rule, 2016 framed under the Customs Act, 1962 apply only to the baggage carried by an international traveller.Justice Krishnan Ramasamy observed that the Rules cannot be extended to articles like jewellery, “carried on the person” of a traveller.The bench observed, “The Customs Act, 1962, enables the Central Government to make Rules to the extent of the articles carried in the baggage of a passenger and not for the articles, which were carried...

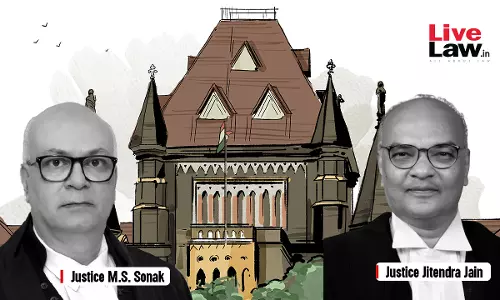

Notice Issued To Non-Existing Entity Post-Merger Is Substantive Illegality, Dept Cannot Cite Technical Glitch: Bombay High Court

The Bombay High Court stated that notice issued to a non-existing entity post-merger is a substantive illegality and not some procedural violation. “we cannot condone the fundamental error in issuing the impugned notices against a non-existing company despite full knowledge of the merger. The impugned notices, which are non-est cannot be treated as “good” as urged on behalf of the department” stated the Division Bench of Justices M.S. Sonak and Jitendra Jain. In this case, the...

Adjustment Of Refund Against Confirmed Demand During Pendency Of Appeal Amounts To Coercive Recovery: CESTAT

The Chandigarh Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that adjustment of refund against a confirmed demand during the pendency of an appeal amounts to coercive recovery. The amount adjusted from the total refund sanctioned to the assessee is refundable to the assessee at the rate of 12% per annum computed from the date of deposit till the date of its refund, stated the bench. Regarding the adjustment of the amount from the total refund...

What Is The Time Period Surviving U/S 149 Of Income Tax Act For Issuing Reassessment Notices: Delhi High Court Explains

The Delhi High Court has interpreted the Supreme Court's decision in Union of India v. Rajeev Bansal to elucidate the time period surviving under Section 149 of the Income Tax Act, 1961 for issuing reassessment notices.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar concluded that the period between 20 March 2020 to 30 June 2021 would be excluded from limitation, in view of Section 3(1) of Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act,...