Tax

Dept Cannot Consider Refund Claim Unless It Specifies Which Notification And Provision It Has Been Sought Under: CESTAT

The Ahmedabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the department cannot consider a refund claim unless it is specified under which notification and provision the same has been sought. The Bench of Somesh Arora (Judicial) has observed that, “The lapse of non-filing of refund under proper notification separately for June 2013 cannot be termed as mere procedural lapse. The department cannot be expected to consider refund claim if it is not...

Adobe India Is Not Dependent Agent PE Of Adobe Ireland: Delhi High Court Negates Attribution Of Further Profits

The Delhi High Court has upheld an order of the Income Tax Appellate Tribunal to the effect that Adobe Systems India Pvt. Ltd is not a dependent agent permanent establishment (DAPE) of Adobe Systems Software Ireland Ltd.In doing so, a division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar affirmed that no further attribution of profit can be made as Adobe India was remunerated at arm's length.As per the AO, Adobe India was not a mere PE (Permanent Establishment) but a DAPE.PE...

Suo Moto Disallowance Made By Assessee Under Bonafide Belief Of Tax Liability Can Be Rectified U/S 264 Of Income Tax Act Without Amending ITR: Delhi HC

The Delhi High Court has held that an application for revision under Section 264 of the Income Tax Act, 1961 can be preferred by an assessee who makes suo motu disallowance in its Return of Income (RoI/ ITR), under a bonafide yet mistaken belief that the same was liable to be offered for taxation.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar added that the assessee cannot be denied relief merely on the ground that the application was moved without amending the...

Date Of Assessment Order Recommending Penalty For Accepting Cash Above ₹2 Lakh Not Relevant For Determining Limitation U/S 275 Of Income Tax Act: Delhi HC

The Delhi High Court has held that the date of the assessment order, wherein an Assessing Officer recommended separate penalty proceedings against the assessee under Section 271DA of the Income Tax Act, 1961 for accepting more than ₹2 lakh in cash, is not relevant for determining the limitation period under Section 275(1)(c).Section 275(1)(c) prescribes the period of limitation within which penalty proceedings are to be completed.A division bench of Acting Chief Justice Vibhu Bakhru and Justice...

Communication Modules Are Imported Independently, Not As Part Of Communication Hubs Or Smart Meters: CESTAT Quashes Customs Duty

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that imported communication modules function independently as parts of communication hubs, classifiable under CTI 8517 70 90. The Bench of Binu Tamta (Judicial Member) and P.V. Subba Rao (Technical Member) have observed that “since the communication modules were imported, they should be classified as such. The correct classification of the communication modules is CTI 8517 70 90.”“Since...

Ensure Counsel Appearing On Advance Service Are Instructed Properly: Delhi HC Asks Customs, GST Department, DRI And DGGI To Frame SOP

The Delhi High Court has asked the Customs Department, the Central GST Department, the Directorate of Revenue Intelligence (DRI), Directorate of General GST Intelligence (DGGI) to make sure that counsel representing them on advance service are instructed properly.A bench of Justices Prathiba M. Singh and Dharmesh Sharma ordered the Commissioner of Customs to prepare an SOP as to the manner in which the Department shall ensure that instructions are given to the nominated Counsels in the matter...

Fees Paid By Law Firm Remfry & Sagar To Use Name & Goodwill Of Founder Is Business Expense, Deductible U/S 37 Of Income Tax Act: Delhi HC

The Delhi High Court has held that the fees paid by IPR law firm Remfry & Sagar to acquire the goodwill vested in a company run by the family members of its deceased founder, is a business expense deductible under Section 37 of the Income Tax Act.A division bench of Justices Yashwant Varma and Ravinder Dudeja observed, “the primary, nay, sole purpose for incurring expenditure towards license fee was to use the words “Remfry & Sagar” and derive benefit of the goodwill attached to it. The...

'Activity Did Not Involve Any Manufacturing, Central Excise Duty Was Collected Illegally': CESTAT Orders Refund

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has granted a refund along with interest, despite the absence of a statutory provision for interest under central excise laws at the relevant time. The Bench of Binu Tamta (Judicial Member) and P.V. Subba Rao (Technical Member) has observed that “the amount collected by way of Central excise duty was illegal as the activity itself did not involve any manufacture and the same cannot be allowed to be...

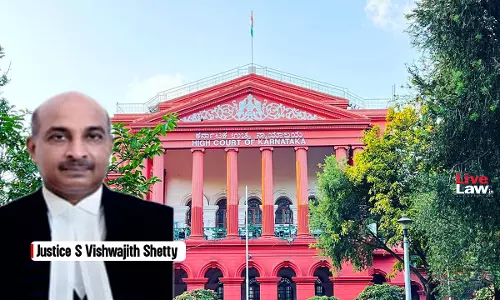

Merely Paying Penalty For Wilful Delay In Filing Income Tax Returns Does Not Exonerate Assessee From Being Prosecuted: Karnataka High Court

The Karnataka High Court has refused to quash prosecution initiated by the Income Tax Department against an assessee who had willfully failed to submit his income tax returns in time for the Assessment Years 2012- 13 to 2015-16 and thereby committed the alleged offence.A single judge, Justice S Vishwajith Shetty dismissed the petitions filed by Rajkumar Agarwal. It said, “Delay in filing of the income tax returns would not only result in payment of penalty, but it also results in prosecution as...

Tax Weekly Round-Up: January 27 - February 02, 2025

HIGH COURTSAndhra Pradesh HCS.12(10) Central Sale Tax (R&T) Rules | Can Certificate Of Export Be Filed After Completion Of Sales Tax Proceedings: AP HC Refers To Full BenchCase title: M/s. Mohan Spintex India Limited v. Commercial Tax Officer and OthersCase no.: WRIT PETITION NOs: 7158/2018,10587/2016, 2514/2020, 6480/2020, 6597/2020, 3111/2021, 40351/2022, 40354/2022, 23960/2023 & 29854 of 2024A Division Bench of the Andhra Pradesh High Court has placed a matter regarding the...

Welfare Measures For Gig Workers, Jan Viswhwas Bill 2.0 : Union Budget 2025 Proposals

In the Union Budget speech, Finance Minister Nirmala Sitharaman made several significant announcements, including the proposal to bring a new income tax bill, reduction of tax slabs and changes to TDS/TCS regime.Welfare security for gig workersApart from this, the Government has decided to provide welfare security for gig workers in India. As per Sitharaman's budget speech, under the Social Security Scheme for the welfare of online platform workers, they will be provided with an identity card...

No TCS On Sale Of Goods; Changes To TDS/TCS Regime : Union Budget 2025 Proposals

With an aim to reform the personal income tax regime with a special focus on middle-class citizens, the Union Finance Minister Nirmala Sitaraman has introduced key changes in the Budget 2025-26 at the August gathering today. Rationalisation of TDS and TCSWith an aim to rationalise Deducted at Source (TDS) and Tax Collected at Source(TCS), the following measures have been introduced:"I propose to rationalise tax deduction at source by reducing the number of rates and thresholds above which...