Tax

Inflating Contract Figures & Complaining That Tax Authorities Based Decision On Such Figures Amounts To Defrauding State In Two Ways: Karnataka HC

The Karnataka High Court stated that inflating contract figures and complaining that tax authorities have premised their decision on such figures, amounts to defrauding state. “Claiming higher contract amount by inflated figures and thereafter complaining that the Tax authorities have premised their decision on such figures, virtually amounts to defrauding the State, in two-ways....

Delhi High Court Grants Relief To Lufthansa Airlines, Sets Aside Revenue's Order Denying 'Nil' TDS Certificate

In a relief to German cargo airline Lufthansa, the Delhi High Court set aside the Revenue's order denying nil TDS certificate to the company for the financial year 2024-25.Section 195 of the Income Tax Act, 1961 deals with the deduction of TDS (Tax Deducted at Source) on payments made to non-resident Indians (NRIs). However, 'nil' withholding tax certificates can be issued under Section...

Tax Weekly Round-Up: March 24 - March 30, 2025

SUPREME COURT'Timelines To Rectify Bonafide GST Form Errors Must Be Realistic' : Supreme Court Asks CBIC To Re-examine ProvisionsCase title : CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS v. M/S ABERDARE TECHNOLOGIES PRIVATE LIMITED & ORS.Case no.: SPECIAL LEAVE PETITION (CIVIL) Diary No. 6332/2025The Supreme Court recently underscored the need for the Central Board of Indirect Taxes...

Relationship Between Searched And Non-Searched Entity Not Mandatory For Invocation Of Proceedings U/S 153C Income Tax Act: Delhi High Court

The Delhi High Court has held that the statutory scheme of Sections 153A and 153C of the Income Tax Act, 1961 does not envisage the discovery of a connection or interrelationship between the searched and the non-searched entity.Section 153A deals with the procedure for assessment which may be set in motion in respect of an entity searched under Section 132 of the Act. Upon such a search...

“Completely Unacceptable”: Delhi High Court Pulls Up Customs For Prolonged Detention Of Export Goods Despite Dept's Circular

The Delhi High Court has criticised the Customs Department for acting against its own Circular for expeditious clearance of goods, by detaining the export goods of a trader for over two months.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed, “This position is completely unacceptable to the Court…consignment cannot be held up in this manner…expedited...

Delhi High Court Slams CBIC For Cryptic Order Denying Duty Drawbacks To Vedanta Despite Its Own Instructions Allowing Retrospective Benefit

The Delhi High Court has asked the Central Board of Indirect Taxes and Customs to pass a “reasoned order” on Indian multinational mining company- Vedanata's plea claiming duty drawbacks on clean energy cess, paid between the year 2010-17.The plea was rejected by CBIC through a “cryptic order” citing limitation despite its own Instruction clearing air on eligibility of drawbacks on...

Student Almanac And Teacher Planner Not Exigible To Excise Duty: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that Student Almanac and teacher planner not exigible to excise duty. The Bench of Justice Dilip Gupta (President) and P.V. Subba Rao (Technical Member) has observed that the submission of the assessee that since Student Almanac is used only by students of a particular school, it becomes...

Non-Payment Of Service Tax By Sub-Contractor Due To Uncertainity Not Wilful Misstatement Or Fraud: Delhi HC Upholds CESTAT Order

The Delhi High Court has upheld an order of the Customs Excise and Service Tax Appellate Tribunal interdicting the GST Department from invoking extended period of limitation for recovery action against a sub-contractor who did not pay service tax amid confusion as to his liability to pay the same.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta upheld the CESTAT order...

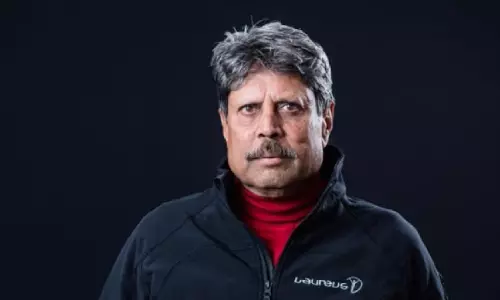

ITAT Exempts Tax On ₹1.5 Crore Granted By BCCI To Kapil Dev In Recognition Of His Services To Cricket

The Income Tax Appellate Tribunal at Delhi allowed renowned cricketer Kapil Dev to claim exemption on Rs. 1.5 crore one-time benefit granted to him by the BCCI in 2013, in recognition of his services.Noting that the cricketer had offered the amount for tax under ignorance, bench of M. Balaganesh (Accountant Member) and MS Madhumita Roy (Judicial Member) said,“It is trite law that right...

Supreme Court Issues Notice In Challenge To West Bengal Taxes On Entry Of Goods Act

The Supreme Court is set to examine the constitutional validity of the West Bengal Taxes on Entry of Goods into the Local Areas Act, 2012, as amended by the West Bengal Finance Act, 2017, along with related Rules and notifications.A bench of Justice JB Pardiwala and Justice R Mahadevan recently issued notice returnable on April 22, 2025 in a batch of petitions challenging the...

Customs Can Clone Data Of Seized Electronic Devices As Per Statutory Procedure, Need Not Retain Devices Throughout Prosecution: Delhi HC

The Delhi High Court has called upon the Customs Department to clone the required data from seized electronic devices of persons allegedly involved in smuggling and other violations under the Act, instead of retaining such devices throughout prosecutions.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed that such a practice will not only ensure that the...

Supreme Court Directs Customs Authorities To Upgrade Lab Facilities For Proper Testing Of Disputed Articles On All Parameters

In a key decision, the Supreme Court today overturned the confiscation of imported goods labelled as "Base Oil SN 50," which customs authorities had classified as High-Speed Diesel (HSD), which only the State entities can import. The Court found that the Customs Department failed to provide conclusive evidence proving the goods were High-Speed Diesel (HSD), due to inadequate laboratory...