High Court

College Supplying Food Through Canteen Managed By Educational Trust Is Liable For Registration Under KVAT Act: Kerala High Court

The Kerala High Court held that college supplying food through canteen, though managed by educational trust, is liable for registration under KVAT Act. The bench disagreed with the assessee that even if it is assumed that the sales in the canteen are found to be assessable under the provisions of the VAT, it falls within the threshold limit and therefore, the assessee cannot be compelled to take registration. It may be true that the sales across the counter in the canteen may be...

Withholding Tax Refunds Without Justification Violates Section 55 Of JVAT Act: Jharkhand High Court

The Jharkhand High Court has held that withholding tax refunds beyond the statutorily prescribed period without adequate justification, violates Section 55 of the Jharkhand Value Added Tax Act, 2005, and deprives the taxpayer of rightful dues. The Court ruled that the refund must carry interest from the date the excess demand was determined, and non-allocation of funds by the State cannot override this obligation.In the words of the Division Bench comprising the Chief Justice MS Ramachadran Rao...

Delhi VAT | No Interest On Refund For Period Of Delay Attributable To Dealer: High Court

The Delhi High Court has held that if the delay in granting refund to a dealer under the Delhi Value Added Tax Act, 2004 is attributable to the dealer itself, such period of delay shall be excluded for the purposes of awarding interest on refund.Section 38(3)(a)(ii) of DVAT Act stipulates a period of two months for refund of excess tax, penalty, etc., if the period for refund is a quarter.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta cited Explanation to Section 42(1)...

Revenue Cannot Re-Assess Time Barred Assessment Under KVAT Act Based On CAG Report: Kerala High Court

The Kerala High Court stated that revenue cannot re-assess time barred assessment under KVAT Act based on CAG report. The Division Bench of Justices A.Y. Jayasankaran Nambiar and Easwaran S. observed that “there cannot be an exercise of power under Section 25A of the KVAT Act beyond the period of limitation prescribed under Section 25(1) of the KVAT Act. In fact the provisions of Section 25A allude to this aspect when it refers to the satisfaction to be recorded by the Assessing...

Andhra Pradesh VAT Act | Pleadings On Suppression Of Material Facts, Wilful Evasion Of Tax Are Sine Qua Non For Invoking S.21(5): High Court

The Andhra Pradesh High Court has held that pleadings relating to suppression of material facts, in an assessment order are the sine qua non for invoking section 21(5); by way of which limitation for filing an assessment order is extended to 6 years from 4 years. "There is nowhere any mention of suppression of facts, much less, wilful suppression of facts, resulting in wilful evasion of tax, which is the sine qua non, for invoking Section 21(5) of the Act. In such circumstances, the...

Penalty Provision U/S 16(7) HP VAT Act Cannot Be Invoked Without First Ascertaining Applicability Of S.16(4): Himachal Pradesh High Court

The Himachal Pradesh High Court has held that the penalty provision couched in Section 16(7) of the HP Value Added Tax Act, 2005 cannot be invoked until the statutory authority is satisfied regarding the applicability of Section 16(4) of the Act.Section 16(4) requires a registered dealer to pay the full amount of tax due from him into a Government Treasury before it furnishes the return. Failure to do so attracts a penalty under Section 16(7).A division bench of Justices Tarlok Singh Chauhan and...

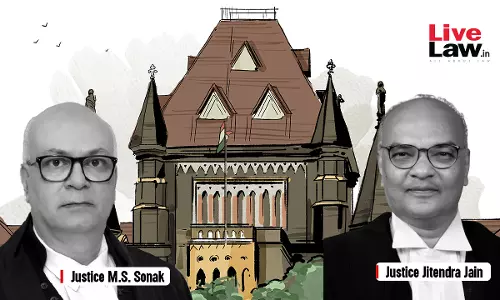

Outstanding Demand Under Maharashtra Settlement Can't Be Adjusted Against Refund Payable Under Maharashtra VAT Act: High Court

The Bombay High Court held that authorities under MVAT Act while exercising powers under Maharashtra Settlement of Arrears of Taxes, Interest, Penalties or Late Fees Act, 2022, cannot invoke provisions of Section 50 of MVAT and that too in review proceedings under Settlement Act.The Division Bench of Justice M. S. Sonak and Justice Jitendra Jain observed that there is no provision under Settlement Act which provides for calculation of outstanding arrears of a particular year to be arrived at...

Notice of Assessment Issued Within Limitation, Assessment Order Valid Even If Passed Beyond Three-Year Period: Madras High Court

The Madras High Court stated that if notice for completing assessment issued within limitation, then assessment order is within time even if passed beyond period of three years. The Division Bench of Justices R. Suresh Kumar and C. Saravanan observed that “as per Section 24(5), no assessment shall be made after a period of three years from the end of the year to which the return under the Act relates. The test to be applied is whether the notice for completing the assessment was ...

“Assessee Entitled To Hearing If Pre-Deposit Is Made”: Gauhati High Court Grants Fresh Hearing

The Gauhati High Court while granting a fresh hearing to the assessee stated that the benefit of hearing has to be given to the assessee as the statutory deposit has already been made by the assessee. The Bench of Justice Arun Dev Choudhury observed that “This court though cannot find fault with the appellate authority in non-entertaining the appeal due to non-compliance of Section 79(5), however this court in exercise of its power under Article 226 of the Constitution of India, in the...

Boro Plus Ayurvedic Cream Is Medicated Ointment, Taxable At 5% Under Entry 41 Schedule II UPVAT Act: Allahabad High Court

The Allahabad High Court has upheld the Commercial Tax Tribunal, Lucknow's finding that Boro Plus Ayurvedic Cream is a 'medicated ointment' and not an 'antiseptic cream'. It was held that Boro Plus Ayurvedic Cream is taxable at 5% under Entry 41 Schedule II of the Uttar Pradesh Value Added Tax Act, 2008. Heading “Drugs and Medicines” in Entry 41, with effective from October 11, 2012, excludes medicated soap, shampoo, antiseptic cream, face cream, massage cream, eye jel and hair oil but...

Denial Of Credit For Non-Registration Thiruvabhranam Commissioner Of Under KVAT Act Is Unjust: Kerala High Court

The Kerala High Court has held that the petitioner/assessee has paid tax at the prescribed rate on the materials procured by him from the Travancore Devaswom Board, and since this amount has already been paid over to the State Exchequer, any denial of credit to the assessee solely on the ground that the Travancore Devaswom Board/Truvabharanam Commissioner was not registered under the KVAT Act would be unjust.The bench of Justice Gopinath P. has observed that the definition of 'casual trader'...

Slump Sale Doesn't Amount To Sale Of Goods Within MVAT Act: Bombay High Court

The Bombay High Court has held that slump sale under the Business Transfer Agreement (BTA) would not amount to sale of goods within the purview of the Maharashtra Value Added Tax (MVAT) Act.The bench of Justice G. S. Kulkarni and Justice Jitendra Jain has observed that it was completely a flawed approach on the part of the reviewing authority to tax part of the BTA considering it to be petitioner's sales/turnover of sales, for the financial year 2010-11 in respect of the amounts of the...