INCOME TAX

Income Tax | Rajasthan High Court Quashes Repeated Orders To Transfer Case, Calls Revenue's Approach 'Rigid' & 'Adamant'

The Rajasthan High Court has come down heavily on the Revenue Department for being “rigid and adamant” to transfer the case of the petitioner from Udaipur to Delhi under Section 127 of the Income Tax Act, 1961, despite the coordinate bench's earlier decision that quashed the same order.Section 127 of the Act empowers the income tax authorities to transfer a case from one Assessing officer...

Notice U/S 148 Income Tax Act Must Be Delivered To Addressee Personally By Post To Complete Service U/S 27: Allahabad High Court

The Allahabad High Court has held that notices under Section 148 and 282 of the Income tax Act, 1961 must be delivered to the assesee personally through speed post and not merely upon his address to complete service under Section 27 of the General Clauses Act, 1897. It held that presumption of sufficient service arises only when the notice is sent by registered post as in registered...

Karnataka High Court Directs CBDT To Extend Tax Audit Due Date To 31st October

The Karnataka High Court today directed the Central Board of Direct Taxes to extend the due date for filing Tax Audit Reports under Section 44AB of the Income Tax Act, 1961, by one month to 31st October, 2025.For reference: “Section 44AB of the Income Tax Act, 1961 mandates compulsory audit of accounts for businesses and professionals above a specified turnover or gross...

Rajasthan HC Grants One Month Extension For Filing Tax Audit Report After Complaints Of Glitches On E-Filing Portal

The Rajasthan High Court has extended the deadline for filing the Tax Audit Report by one month. A division bench of Justice (Dr.) Pushpendra Singh Bhati and Justice Bipin Gupta at the Rajasthan High Court extended the deadline under Section 44AB of the Income Tax Act, 1961, by 1 (one) month beyond September 30, 2025. It was submitted that in the previous years, CBDT had...

Income Tax Act | To Claim Deduction U/S 54F, Assessee Must Show Intention To Repay Borrowed Funds With Capital Gains: Kerala HC

The Kerala High Court stated that to claim the Section 54F deduction under the Income Tax Act, the assessee must satisfy the authorities that borrowed funds were used at their own risk with the intention to be repaid with capital gains. Section 54F of the Income Tax Act, 1961, allows a tax exemption on capital gains earned from selling a residential property, but only if certain...

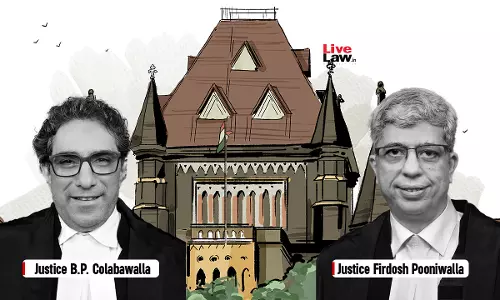

Income Tax Act | Payment To Consulting Doctors Appointed On Probation Is Not Salary; TDS Deductible U/S 194J, Not U/S 192: Bombay High Court

The Bombay High Court has held that payments to consultant doctors are not salary. Hence, TDS is deductible under section 194J and not under section 192 of the Income Tax Act. Justices B.P. Colabawalla and Firdosh P. Pooniwalla stated that there does not exist an employer-employee relationship between the assessee and consultant doctors, and the payments made to them by the...

Income Tax Act | Draft Assessment Order Not Permissible U/S 144C(1) When TPO Makes No Variation: Bombay High Court

The Bombay High Court has held that a draft assessment order is not permissible under section 144C(1) of the Income Tax Act when the TPO (transfer pricing officer) makes no variation. Section 144C(1) of the Income Tax Act, 1961, provides that the Assessing Officer should forward a draft of the proposed assessment order to the eligible assessee if any variation of the income or...

S. 149 Income Tax Act | Reassessment Beyond Limitation Period Is Valid Where 'Bogus' Royalty Payments Exceed ₹50 Lakh: Bombay High Court

The Bombay High Court has stated that reassessment beyond 3 years is valid where bogus royalty expenses exceed Rs. 50 lakhs. Justices Bharati Dangre and Nivedita P. Mehta upheld the reassessment proceedings initiated beyond three years, in the present case, where the alleged bogus royalty expenses exceeded 50 Lakhs. The bench opined that Section 149(1)(b) of the Income Tax Act is...

Sale Proceeds Of Minor's Property Share Deposited Under Court Order Excluded From Father's Taxable Income: ITAT

The Chennai Bench of Income Tax Appellate Tribunal (ITAT) has stated that sale proceeds of a minor's property share deposited under court order are excluded from father's taxable income. S.S. Viswanethra Ravi (Judicial Member) held that the assessee cannot decide the utilization of his minor daughter's share as it is deposited as per Court's order and it is impossible to club the same...

Surprise Searches Can Be Conducted On Family's Lockers U/S 132 Of Income Tax Act Over Suspicion Of Undisclosed Assets: Delhi High Court

The Delhi High Court has upheld the surprise search and seizure conducted by the Income Tax Department at the private lockers maintained by a family at South Delhi Vaults, without issuance of prior notice or summons to them.The family claimed that failure to notify them was a flagrant violation of Section 132 of the Income Tax Act, 1961 which relates to 'Search and seizure'.Section...

Employees' Contributions Must Be Paid By Due Date Under ESI/EPF Act, Not Income Tax Act: Delhi High Court

The Delhi High Court has held that an employer can claim deduction of employees' contributions towards Provident Fund or Employer's State Insurance Fund, held by it in trust, only if it deposits these amounts on or before the statutory due date prescribed under the relevant labour law.Section 36(1)(va) of the Income Tax Act, 196 pertains to employees' contribution. It stipulates that...

Assessee Cannot Be Asked To Prove Non-Occurrence Of Transaction Once Documentary Evidence Is Produced: ITAT

LThe Mumbai Bench of Income Tax Appellate Tribunal (ITAT) has stated that the assessee is not required to prove negative once documentary evidence is produced.Section 69C of the Income Tax Act, 1961 provides that if an assessee incurs any expenditure during a financial year and fails to provide a satisfactory explanation, or if the Assessing Officer does not accept the explanation, the amount...