High Courts

Limitation Under Rule 68B Of Income Tax Act Does Not Apply To RDDB Act Proceedings: Kerala High Court

The Kerala High Court held that the limitation under Rule 68B of the second schedule to the Income Tax Act does not apply to RDDB Act (Recovery of Debts Due to Banks and Financial Institutions Act, 1993) proceedings. Justice Mohammed Nias C.P. stated that Rule 68B of the Second Schedule to the Income Tax Act, 1961, has no mandatory application to recovery proceedings under the RDDB...

Income Tax Act | Non-Production Of Form 3CL Isn't Material Suppression; Not Grounds To Reopen Assessment U/S 147: Kerala High Court

The Kerala High Court held that the non-production of Form 3CL is not material suppression and is not a valid ground to reopen the assessment under Section 147 of the Income Tax Act. Under Section 35(2AB) of the Income Tax Act, 1961, any expenditure on scientific research is allowable as a deduction. A sum equal to one and one-half times the expenditure is allowed as such a...

Income Tax Act | Deputy Commissioner Cannot Act Beyond DRP Directions; Assessment After S.144C(13) Time Limit Invalid: Bombay High Court

The Bombay High Court stated that the Deputy Commissioner cannot act beyond the dispute resolution panel (DRP) directions; assessment completed beyond Section 144C(13) of the Income Tax Act, 1961, the time limit is invalid. Section 144C(13) of the Income Tax Act, 1961 mandates the completion of the assessment within one month from the end of the month in which DRP directions are...

Income Tax | Manual Filing Of Appeal By NRI Valid For DTVSV Scheme Benefits: Gujarat High Court

The Gujarat High Court held that the manual filing of an appeal by an NRI is valid for DTVSV (Direct Tax Vivad Se Vishwas Scheme, 2024) Scheme Benefits. Justices Bhargav D. Karia and Pranav Trivedi were addressing the case where the petitioner/assessee has challenged the communication issued by the respondent authorities, whereby the declaration made by the assessee under the Direct...

Delhi High Court Drops Suo Moto Contempt Action Against Income Tax Officer For Allegedly Passing Unreasoned Order

The Delhi High Court has dropped the civil contempt proceedings initiated against a Principal Commissioner of Income Tax (now retired) six years ago, for alleged wilful disobedience of its order to give reasons for insisting an assessee to deposit 20% demand in appeal.The proceedings were initiated suo moto in 2019 on a prima facie opinion but on a closer scrutiny, Justice Vikas Mahajan now...

Income Tax Act | Assessee Can Challenge Cash Credit Addition U/S 68 In Remand Proceedings; Tribunal's Direction Not Binding: Kerala High Court

The Kerala High Court held that the assessee is free to challenge the cash credit addition under Section 68 of the Income Tax Act in remand proceedings; the tribunal's directions are not binding. As per Section 68 of the Income Tax Act, 1961, any sum found credited in the books of a taxpayer, for which he offers no explanation about the nature and source thereof or the...

Income Tax | Rajasthan High Court Quashes Repeated Orders To Transfer Case, Calls Revenue's Approach 'Rigid' & 'Adamant'

The Rajasthan High Court has come down heavily on the Revenue Department for being “rigid and adamant” to transfer the case of the petitioner from Udaipur to Delhi under Section 127 of the Income Tax Act, 1961, despite the coordinate bench's earlier decision that quashed the same order.Section 127 of the Act empowers the income tax authorities to transfer a case from one Assessing officer...

Notice U/S 148 Income Tax Act Must Be Delivered To Addressee Personally By Post To Complete Service U/S 27: Allahabad High Court

The Allahabad High Court has held that notices under Section 148 and 282 of the Income tax Act, 1961 must be delivered to the assesee personally through speed post and not merely upon his address to complete service under Section 27 of the General Clauses Act, 1897. It held that presumption of sufficient service arises only when the notice is sent by registered post as in registered...

Karnataka High Court Directs CBDT To Extend Tax Audit Due Date To 31st October

The Karnataka High Court today directed the Central Board of Direct Taxes to extend the due date for filing Tax Audit Reports under Section 44AB of the Income Tax Act, 1961, by one month to 31st October, 2025.For reference: “Section 44AB of the Income Tax Act, 1961 mandates compulsory audit of accounts for businesses and professionals above a specified turnover or gross...

Rajasthan HC Grants One Month Extension For Filing Tax Audit Report After Complaints Of Glitches On E-Filing Portal

The Rajasthan High Court has extended the deadline for filing the Tax Audit Report by one month. A division bench of Justice (Dr.) Pushpendra Singh Bhati and Justice Bipin Gupta at the Rajasthan High Court extended the deadline under Section 44AB of the Income Tax Act, 1961, by 1 (one) month beyond September 30, 2025. It was submitted that in the previous years, CBDT had...

Income Tax Act | To Claim Deduction U/S 54F, Assessee Must Show Intention To Repay Borrowed Funds With Capital Gains: Kerala HC

The Kerala High Court stated that to claim the Section 54F deduction under the Income Tax Act, the assessee must satisfy the authorities that borrowed funds were used at their own risk with the intention to be repaid with capital gains. Section 54F of the Income Tax Act, 1961, allows a tax exemption on capital gains earned from selling a residential property, but only if certain...

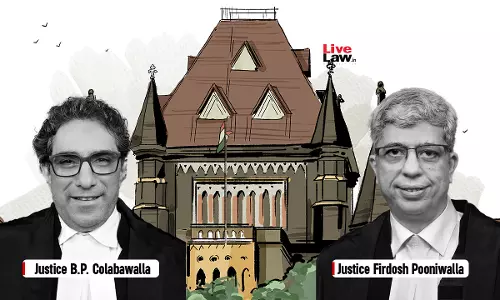

Income Tax Act | Payment To Consulting Doctors Appointed On Probation Is Not Salary; TDS Deductible U/S 194J, Not U/S 192: Bombay High Court

The Bombay High Court has held that payments to consultant doctors are not salary. Hence, TDS is deductible under section 194J and not under section 192 of the Income Tax Act. Justices B.P. Colabawalla and Firdosh P. Pooniwalla stated that there does not exist an employer-employee relationship between the assessee and consultant doctors, and the payments made to them by the...