High Courts

Income Tax Act | Draft Assessment Order Not Permissible U/S 144C(1) When TPO Makes No Variation: Bombay High Court

The Bombay High Court has held that a draft assessment order is not permissible under section 144C(1) of the Income Tax Act when the TPO (transfer pricing officer) makes no variation. Section 144C(1) of the Income Tax Act, 1961, provides that the Assessing Officer should forward a draft of the proposed assessment order to the eligible assessee if any variation of the income or...

S. 149 Income Tax Act | Reassessment Beyond Limitation Period Is Valid Where 'Bogus' Royalty Payments Exceed ₹50 Lakh: Bombay High Court

The Bombay High Court has stated that reassessment beyond 3 years is valid where bogus royalty expenses exceed Rs. 50 lakhs. Justices Bharati Dangre and Nivedita P. Mehta upheld the reassessment proceedings initiated beyond three years, in the present case, where the alleged bogus royalty expenses exceeded 50 Lakhs. The bench opined that Section 149(1)(b) of the Income Tax Act is...

Surprise Searches Can Be Conducted On Family's Lockers U/S 132 Of Income Tax Act Over Suspicion Of Undisclosed Assets: Delhi High Court

The Delhi High Court has upheld the surprise search and seizure conducted by the Income Tax Department at the private lockers maintained by a family at South Delhi Vaults, without issuance of prior notice or summons to them.The family claimed that failure to notify them was a flagrant violation of Section 132 of the Income Tax Act, 1961 which relates to 'Search and seizure'.Section...

Employees' Contributions Must Be Paid By Due Date Under ESI/EPF Act, Not Income Tax Act: Delhi High Court

The Delhi High Court has held that an employer can claim deduction of employees' contributions towards Provident Fund or Employer's State Insurance Fund, held by it in trust, only if it deposits these amounts on or before the statutory due date prescribed under the relevant labour law.Section 36(1)(va) of the Income Tax Act, 196 pertains to employees' contribution. It stipulates that...

AO Can Determine Annual Value Of Property Higher Than Municipal Rateable Value U/S 22 Income Tax Act: Bombay High Court

The Bombay High Court stated that the assessing officer (AO) can determine the annual value of the property higher than the municipal rateable value under Section 22 of the Income Tax Act. Section 22 of the Income Tax Act, 1961 deals with the "taxability of 'Income from House Property”. It says the annual value of property consisting of any buildings or lands appurtenant thereto...

Cash Deposits During Demonetisation Not 'Unexplained Money' If Traceable To Previous Year's Balance: Chhattisgarh High Court

The Chhattisgarh High Court held that cash deposits during demonetisation are not unexplained money if traceable to previous year's balance. Section 69 of the Income Tax Act, 1961 requires the assessee to provide proof of income and provide a proper explanation of the source of such unexplained income. Justices Sanjay K. Agrawal and Deepak Kumar Tiwari stated that the factum...

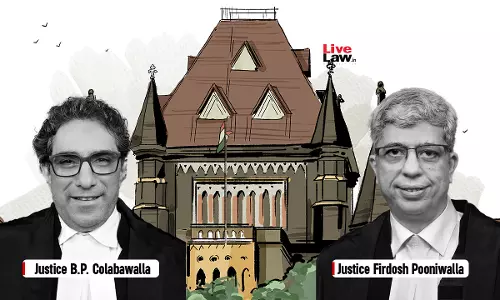

Income Tax | Interest On Fixed Deposits, TDS Refund Linked To Business Qualifies For S. 80IA Deduction: Bombay High Court

The Bombay High Court held that interest on fixed deposits, TDS refund linked to business qualifies for deduction under Section 80IA of the Income Tax Act. Section 80IA of the Income Tax Act, 1961 provides tax incentives for businesses operating in certain sectors such as infrastructure, power, and telecommunications. Justices B.P. Colabawalla and Firdosh P. Pooniwalla...

S.263 Income Tax Act | Commissioner Cannot Revise Assessment Merely Because Detailed Reasoning Was Not Given: Madras High Court

The Madras High Court stated that the Income Tax commissioner cannot revise an assessment merely because detailed reasoning was not given in the order. Section 263 of the Income Tax Act, 1961, empowers the Commissioner of Income Tax to revise any order passed under the Income-tax Act, 1961, “the Act” which is erroneous insofar as it is prejudicial to the interest of...

Income Tax | Sale Proceeds Of Vintage Cars Taxable Unless Assessee Proves That Car Was Used As Personal Asset: Bombay High Court

The Bombay High Court held that sale proceeds of vintage car taxable unless the assessee proves that the car was used as a personal asset. Chief Justice Alok Aradhe and Justice Sandeep V. Marne stated that the capability of a car for personal use would not ipso facto lead to automatic presumption that every car would be personal effects for being excluded from capital assets of...

Income Tax | Interest Earned On Surplus Lending Funds Is Attributable To Banking Business, Qualifies For 80P Deduction: Calcutta High Court

The Calcutta High Court stated that interest earned on surplus lending funds is attributable to banking business, qualifies for 80P deduction under Income Tax Act. Section 80P of the Income Tax Act, 1961 provides 100% tax deductions to cooperative societies for income from specified activities. These activities commonly include marketing agricultural produce, purchasing...

Income Tax Act | Criminal Complaint For Tax Evasion Filed During Pendency Of Reassessment Proceedings Not Premature: Delhi High Court

The Delhi High Court recently dismissed a plea for quashing a criminal complaint lodged under Income Tax Act 1961 for alleged tax evasion, moved on the ground that reassessment action was pending and hence the complaint was premature.The bench of Justice Neena Bansal Krishna cited P. Jayappan vs. S.K. Perumal, First Income Tax Officer [1984] where it was held that pendency of...

Income Tax | S.194C & S.194LA Would Not Apply When TDR Certificates Are Issued In Lieu Of Compensation: Bombay High Court

The Bombay High Court held that Section 194C and Section 194LA of the Income Tax Act would not apply when TDR Certificates are issued in lieu of compensation. Justices B.P. Colabawalla and Firdosh P. Pooniwalla agreed with the assessee that the words “or by any other mode” appearing in Section 194C would have to be read ejusdem generis to the words “payment thereof in cash or...